Why Estate Planning Isn’t Optional Anymore

Estate planning isn’t just for retirees or the ultra wealthy. It’s a practical move every investor should make early and revisit often. Get your plan in place when things are calm, not when you’re under pressure. That way you’re not navigating legal and financial complexity during a crisis.

Starting early gives you real advantages. You get time to use tax strategies that aren’t available last minute. You also reduce the chance of probate delays, family disputes, or assets getting tied up in court. For investors, that’s peace of mind and control.

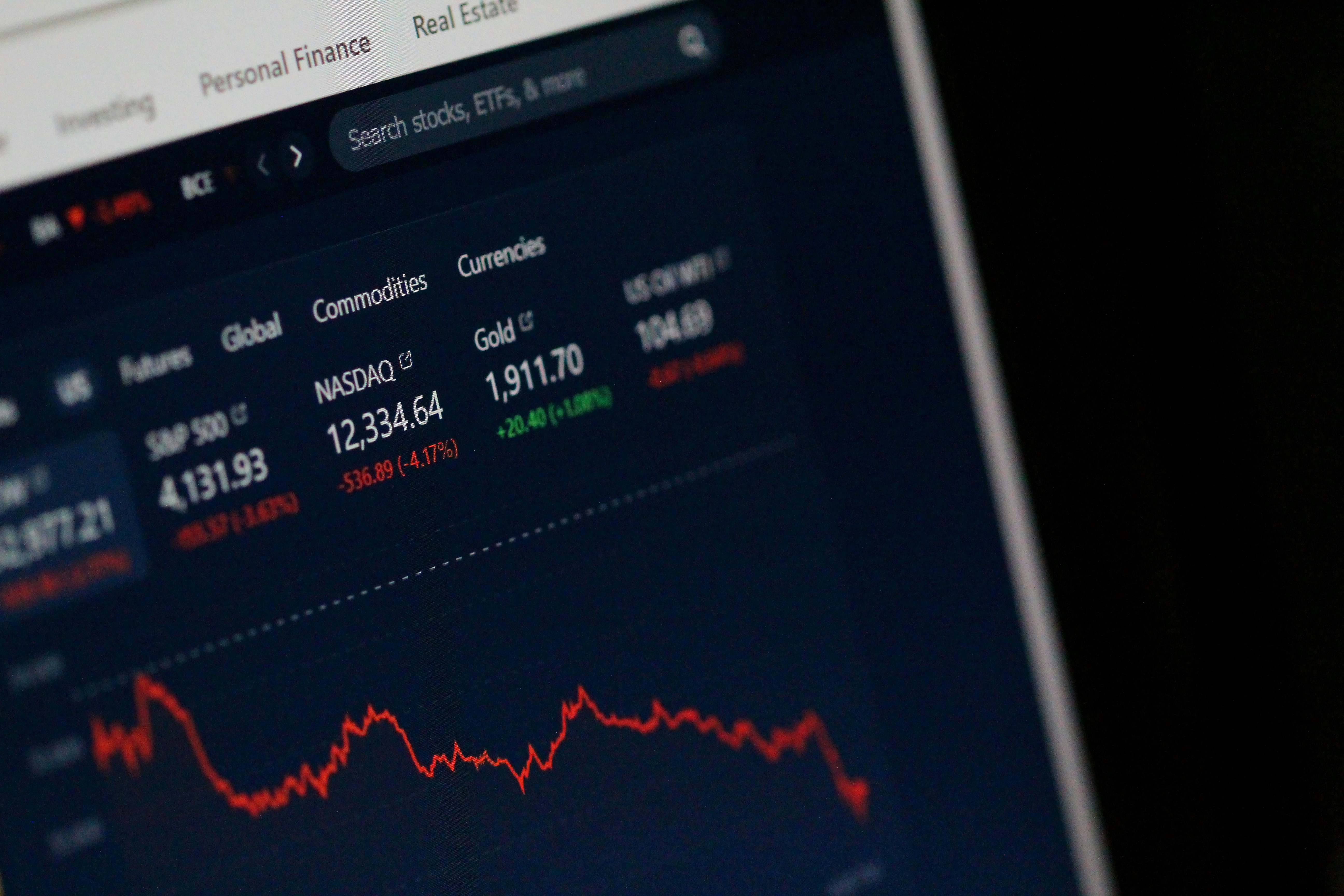

Looking ahead to 2026, high net worth individuals face new tax thresholds and potential estate tax hikes. The IRS tends to swing back after periods of generous exemptions and that window may close sooner than expected. If your assets are over $6 million, your estate could take a major hit without a solid plan.

Waiting too long leaves you exposed. Without documented wishes, your portfolio might be liquidated inefficiently, properties mishandled, or businesses at risk. States have default laws, sure but those rarely reflect your values or long term goals.

Estate planning isn’t about fear. It’s about intention. Decide what happens to your wealth before someone else does it for you.

Core Components You Can’t Ignore

When it comes to estate planning, skipping the basics can cause the most damage. Let’s break down the pieces that matter.

Wills and trusts do different jobs. A will kicks in after you die. It tells the court who gets what, but it goes through probate a public, sometimes lengthy process. A trust, on the other hand, can bypass probate. It lets you control how assets are distributed, even long after you’re gone. Trusts are more flexible, but they take more effort up front. Many smart investors use both.

Then there are healthcare directives and durable powers of attorney. These don’t deal with your money they deal with you. If you’re incapacitated, a healthcare directive spells out your medical preferences. A durable power of attorney names someone to handle your finances. Without them, courts could end up making calls that clash with your wishes.

Your executor or trustee needs to be more than trustworthy. They need to be practical. Choose someone who understands money or is smart enough to hire people who do. This is the person who’ll manage your legacy when you can’t.

And don’t forget your digital life. Online accounts, crypto wallets, even family photos stored in the cloud these are assets too. Make sure your estate plan includes clear instructions on how to access or transfer them. Otherwise, they could get locked away or lost for good.

Get these core components right, and you’ve covered the fundamentals.

Strategic Moves Investors Are Making Now

Estate planning isn’t just about avoiding taxes it’s about timing, structure, and control. High net worth individuals are leaning into proven strategies that do more than protect assets. They pass them on smartly.

Start with grantor trusts. These structures let you move appreciating assets out of your estate while still shouldering the tax bill ironically a good thing. This keeps future gains from being taxed under your estate and allows the trust to grow more efficiently for your heirs.

Next are gifting strategies. The 2026 sunset of the Tax Cuts and Jobs Act could slash today’s generous estate and gift tax exemption in half. That has shifted many investors into urgency mode. Strategic gifting now through annual exclusion gifts, or outright transfers using today’s higher exemption can lock in major savings.

Then there’s the family limited partnership. It lets you centralize management of assets like real estate or a family business while reducing their taxable value through discounting. Paired with a charitable foundation, you not only reduce estate tax exposure you create a long term legacy aligned with family values.

None of these work without timing. Transfer assets too late, and you lose control or tax advantages. Go too early, and you risk overcommitting before you know your needs. Estate planning isn’t static it’s a moving target that demands awareness and urgency.

Explore how Asset Allocation Strategies Can Preserve Wealth

Pitfalls That Can Wreck an Estate Plan

Even the most well intentioned estate plan can unravel without diligent upkeep and preparation. Investors often assume once their documents are signed, the work is done but missteps and oversights can create serious consequences down the line.

Outdated Documents and Inconsistent Asset Titling

Time is not always kind to estate plans. As life changes marriage, divorce, new children, or shifts in wealth outdated paperwork can lead to conflicts or unintended distributions.

Regularly review all wills, trusts, and beneficiary designations

Ensure that account titles match the intentions laid out in your plan

Update documents whenever a major life change occurs

Overlooking Business Succession Plans

If you own a business, your estate plan must include a roadmap for what happens next. Without a clear succession plan, disputes, tax issues, or business closure become real risks.

Identify future leadership early and communicate expectations

Use buy sell agreements to outline transfer terms

Coordinate the succession plan with your broader estate strategy

Assuming State Laws Will Protect You

Estate laws vary significantly by state, and relying on default legal protections can be dangerous.

Understand how your state handles probate, spousal rights, and community property

Avoid unintended exclusions or tax hits by consulting qualified legal counsel

Customize your plan based on state specific inheritance laws

Underestimating the Cost of Probate

Probate is often more expensive and time consuming than many expect. Without proper planning, your heirs may face court delays, legal fees, and public disclosure of assets.

Consider using revocable living trusts to keep assets out of probate

Be aware of how titling and beneficiary designations affect the process

Work with advisors to minimize administrative costs and delays

Keeping your estate plan current and coordinated is just as important as having one. By avoiding these common pitfalls, you protect your assets and the people you intend to benefit from unnecessary legal and financial stress.

Protecting Your Legacy for the Long Term

Estate plans aren’t meant to be carved in stone. Life changes divorces, new grandchildren, a business sale, a shift in tax law can make yesterday’s airtight plan today’s liability. Build flexibility in from the beginning. That might mean using revocable trusts, adding language that allows updates to distribution terms, or granting your trustee discretionary powers. Bottom line: the more rigid your plan, the more risk it carries.

Next comes the part most people skip: preparing your heirs. You can transfer assets, but if you don’t also transfer wisdom and context, wealth erodes fast. Start the conversation early. Talk openly about the why behind your choices, not just who gets what. Whether it’s through family meetings, a letter of intent, or a recorded message, give your legacy meaning beyond the paperwork.

Finally, treat your estate plan like a living document. Review it yearly and every time life lobs a curveball. That includes major moves, career changes, family events, and new tax policies. Waiting too long leads to confusion or worse, litigation. Consistent reviews don’t just protect your assets; they protect your voice after you’re gone.