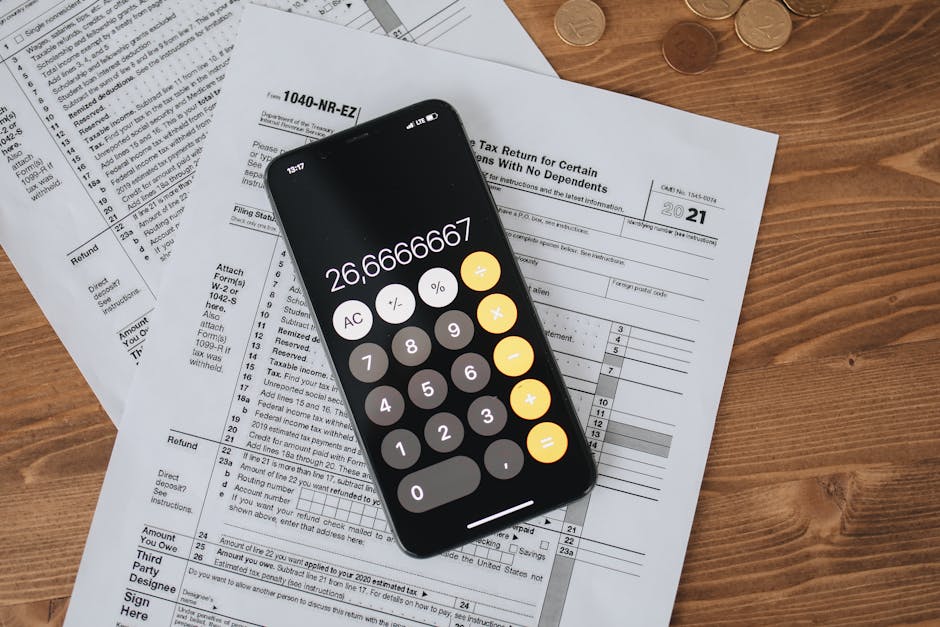

How Tax Planning Impacts Your Wealth Strategy

Why Tax Planning Deserves a Seat at the Table This isn’t just about hunting for deductions or shrinking your April tax bill. Tax planning is about building a system that lets you keep more of what you earn year after year. It’s a long game, not a quick fix. Every dollar you make or invest […]

How Tax Planning Impacts Your Wealth Strategy Read More »