What Sector Rotation Really Is

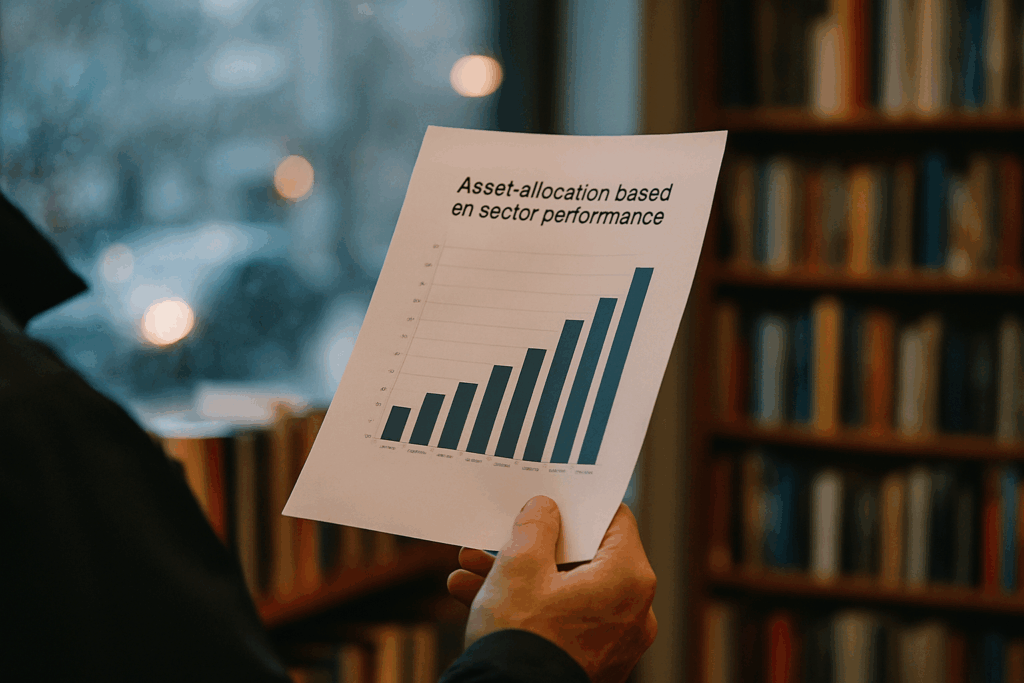

Sector rotation is the movement of money across different sectors of the economy think tech, healthcare, energy, financials depending on where investors expect the most growth or stability. When investors rotate capital, they’re recalibrating based on where the opportunity (or safety) is most likely to be.

This isn’t new. Rotation follows the natural rhythm of economic cycles. During expansions, money tends to flow into more aggressive, growth oriented sectors like tech or consumer discretionary. When the economy cools or contracts, defensive sectors healthcare, utilities, staples get more attention. Investors shift their exposure to ride the wave or brace for a downturn.

In 2026, several macro forces are rewriting the rules of rotation. Interest rates remain elevated, inflation pressure lingers, and global supply chains are still realigning post pandemic. Meanwhile, geopolitical instability and energy transitions are spotlighting real assets and commodities. These factors aren’t just shaping sentiment they’re materially pulling capital from one sector to another.

Understanding how and why capital moves can give investors a serious edge. Sector rotation isn’t chaos it’s a signal. And in the uneven terrain of 2026, it’s a critical one.

Typical Rotation Cycle and Key Phases

Sector rotation isn’t just a Wall Street buzzword it’s a rhythm that plays out across every economic cycle. Different sectors tend to outperform depending on whether the economy is growing, peaking, contracting, or recovering. Understanding who leads and who lags at each phase can mean the difference between riding the wave and getting caught in the undertow.

In early expansion think recovery from recession you’ll usually see leadership from cyclical sectors like consumer discretionary, financials, and industrials. These respond well to improving economic conditions and rising consumer confidence. As the expansion matures, tech and communications often thrive, benefitting from stable growth and innovation tailwinds.

At the peak or start of a slowdown, leadership tends to shift to defensive plays healthcare, utilities, and consumer staples. These sectors offer consistency when growth slows and investor anxiety creeps in. Energy and materials can also shine late in the cycle, especially if inflation pressures rise.

Risk on vs. risk off behavior also shapes sector performance. In a risk on environment where investors are optimistic and chasing returns cyclical and growth names dominate. In risk off phases typically during uncertainty or downturns defensive sectors and high dividend payers become shelters.

As of mid 2026, recent data suggests we’re in a late cycle environment. Consumer discretionary and tech are cooling off after a strong run. Healthcare and utilities are beginning to see steady inflows. Real assets and energy have picked up as inflation remains sticky and rates stay elevated. For now, markets are playing defense but staying alert to a turning point.

How to Spot a Rotation Early

Sector rotation isn’t loud. It doesn’t flash neon signs. It leaves tracks subtle at first in price action and volume trends. That’s where the sharp eyes look. When money starts moving between sectors, you’ll often see relative strength in one industry ETF while others stall. Financials ticking up while tech slows? That’s a clue. A pickup in healthcare volume while consumer discretionary fades? Another sign. You don’t need to chase every tick, but keeping a watchlist of sector ETFs and scanning for breakouts or sustained momentum is just smart.

Earnings season can break a sector open or shut it down. Forward guidance matters more than the print. If a whole industry starts raising expectations and showing growth where the market expected contraction, the big players pay attention. That ripple becomes a wave when multiple companies point in the same direction.

The best investors don’t always try to time it perfectly. They position. That means recognizing early strength, scaling in, and letting the rotation prove itself before going all in. You’re managing risk while staying in the flow. Because when capital truly rotates, it doesn’t just knock it kicks the door open.

Sector Standouts in 2026

Defensive Sectors Are Gaining Momentum

As economic growth begins to soften in 2026, investors are gravitating toward sectors that tend to hold up well in uncertain environments. Defensive sectors, known for their resilience during market slowdowns, are beginning to outperform more cyclical areas of the market.

Key standouts include:

Utilities: Steady dividends and essential services make this sector a traditional refuge during slower growth periods.

Healthcare: Maintains demand regardless of economic cycles, offering stability and long term potential.

Consumer Staples: Companies providing everyday essentials continue to generate revenue despite tightening consumer budgets.

Cooling Off: Former Leaders Lose Steam

Several high flying sectors from previous years are showing signs of deceleration. Rising interest rates and shifting consumer behavior are prompting a retreat from growth heavy segments.

Sectors cooling down:

Technology: After years of outperformance, tech stocks are facing stiffer competition, tighter margins, and valuation concerns.

Consumer Discretionary: Inflation and wage concerns are weighing on consumers, leading to reduced spending on non essential goods and services.

Real Assets and Energy Back in Focus

With inflation remaining a key theme in 2026, investors are revisiting real assets and commodity linked sectors. These areas are gaining attention as both inflation hedges and revenue positive plays in supply constrained markets.

Benefiting sectors:

Energy: As geopolitical tensions persist and supply remains tight, energy names are posting strong earnings.

Real Estate Investment Trusts (REITs): Select REITs with inflation linked cash flows are finding renewed interest.

Materials: Demand for physical inputs especially those tied to infrastructure and green energy continues to grow.

For a deeper breakdown of the economic backdrop shaping these moves, explore this resource: Current Economic Indicators and What They Signal for Investors

How Investors Use Sector Rotation

There are two paths when it comes to playing sector rotation: tactical shifts or sticking with long term core holdings. Tactical asset allocation is about tilting your portfolio toward sectors that are gaining strength in the current economic phase think overweighting energy during inflationary bursts, or shifting into consumer staples when growth starts to slow. It’s hands on, and timing matters.

Long term core holdings, on the other hand, are about staying steady. These portfolios often include broad market ETFs or a blend of sectors that smooth out over time. It’s the slow and steady approach, less reactive and more about riding out market cycles without jumping in and out.

To apply either strategy, investors use tools like sector specific ETFs, mutual funds, or carefully selected individual stocks. ETFs are the fastest route liquid, diversified, and easy to trade. Mutual funds are often slower but come with professional management. And for those who want more control (and more work), picking individual stocks can add alpha or risk.

Biggest pitfall? Chasing performance. Just because tech was hot last quarter doesn’t mean it’s your best move now. Sector rotation isn’t about betting on winners from the rearview it’s about spotting shifts early and positioning before the crowd.

Smart investors zoom out, watch data, and rotate with purpose, not panic.

Bottom Line for 2026

Sector rotation isn’t just a market quirk it’s a message and a method. When capital moves between sectors, it’s telling you something about where the economy is and where it may be headed. Ignore that message, and you’re flying blind. Embrace it, and you can align your strategy with the market’s underlying rhythm.

Cycles don’t carbon copy themselves. What led last time might lag now. But the rhyme still happens momentum shifts, asset classes rotate, and themes emerge in a familiar order. Understanding the pattern won’t make you a perfect market timer, but it will keep you from being caught flat footed.

More than anything, adapting to sector rotation requires a mix of discipline and flexibility. You can’t anchor yourself to yesterday’s winners. You have to stay tuned to macro signals, earnings trends, and capital flows. The investors who last aren’t the ones who always guess right they’re the ones who act based on what the market’s actually showing them.