Why Asset Allocation Isn’t Optional

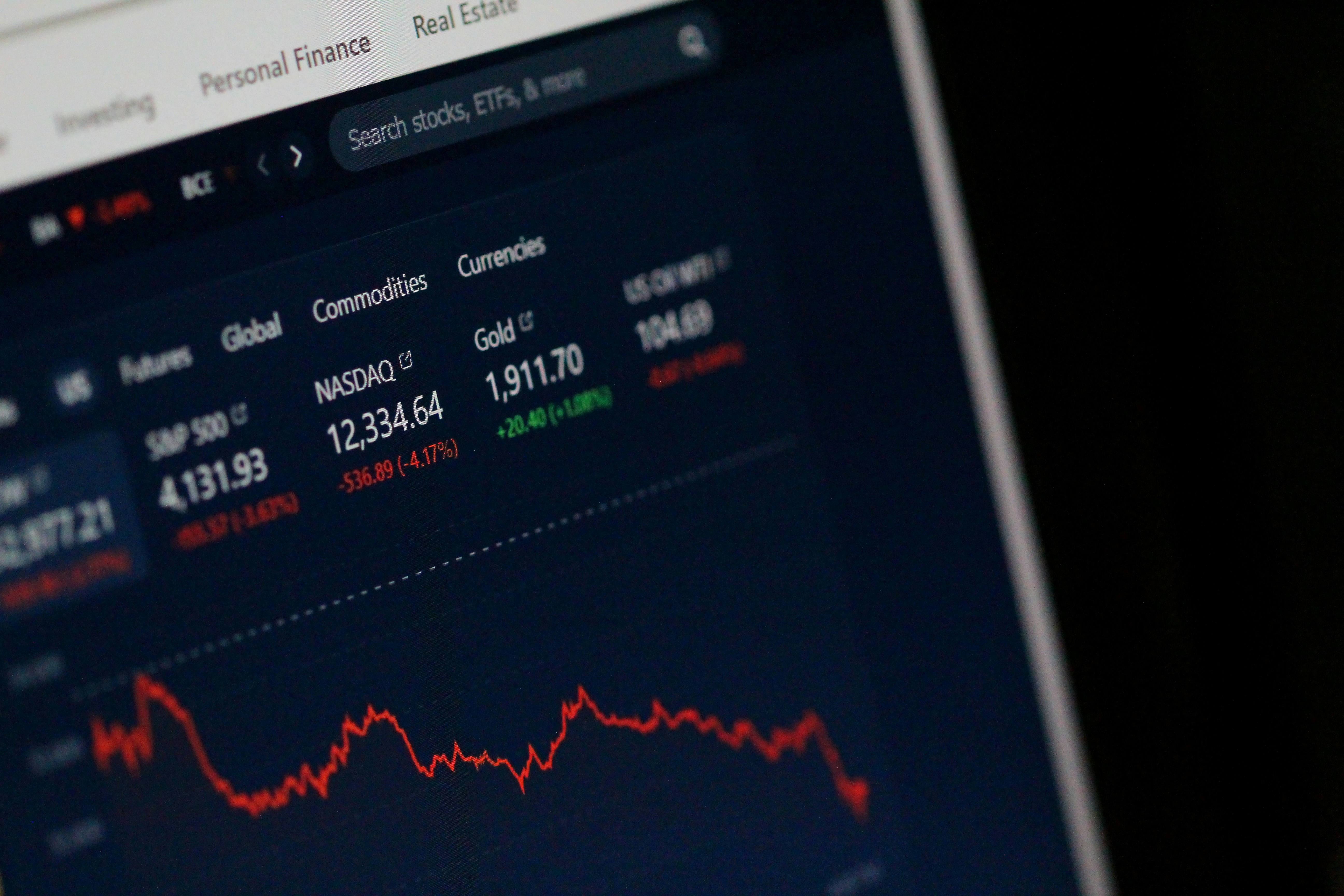

Everyone wants to outsmart the market. But consistently guessing right is a losing game. The truth is simple: long term wealth doesn’t come from timing the market it comes from time in the market. Staying invested through both the highs and the lows gives compounding the runway it needs to work.

That’s where asset allocation comes in. It’s not how often you trade or when you buy. It’s how your money is divided across different asset types stocks, bonds, cash, maybe a little real estate or alternatives. This mix of assets, more than any single stock pick, drives your overall portfolio performance.

Diversification spreads your risk. When one part of the portfolio dips, another might cushion the blow. That balance adds stability and keeps your strategy from being completely wrecked by one wrong call. With a solid allocation plan, you’re not trying to be a hero. You’re playing the long game and that’s where wealth is really built.

Core Allocation Strategies That Work

No magic here just three core buckets: stocks, bonds, and cash. Stocks offer growth. Bonds offer stability. Cash offers liquidity. Smart allocation is about how much you put in each, and why. You’ll shuffle the mix depending on your goals, time horizon, and tolerance for chaos.

One approach is by age. The old formula: subtract your age from 100 to get your stock percentage. It’s simple, and it works, especially if you’re just getting started and want a glide path toward lower risk. But cookie cutter isn’t for everyone. Some people can sleep through market mayhem; others panic at headlines. That’s where risk tolerance based models step in, basing allocations more on behavior than birth year.

Then there’s strategic vs. tactical allocation. Strategic is the blueprint long term, steady, don’t sweat the news thinking. Tactical is more active: adjusting weights based on market conditions or opportunities. Strategic keeps you grounded. Tactical gives you flexibility. Use both wisely, and you’ve got a plan that can weather most storms but only if you stick with it.

Modern Portfolio Approaches

For investors playing the long game, diversification can’t stop at the usual trio of stocks, bonds, and cash. Alternative investments like REITs, commodities, and private equity are carving out larger roles in smart portfolios. Why? They don’t move in sync with traditional markets. That means when stocks tank, alternatives can help hold the line. Real estate (especially through REITs) can offer income and inflation protection. Commodities hedge against volatility. And private equity brings long term growth potential, albeit with less liquidity.

Then there’s global diversification. Betting everything on your home market is shortsighted. Economic growth, innovation, and value aren’t confined by borders. International equities and bonds not just emerging markets, but developed ones too open up new performance and risk balancing opportunities. The wider the mix, the less likely a single downturn drags your entire portfolio under.

Finally, rebalancing is where strategy meets discipline. Markets shift. Allocations drift. You don’t want to get overexposed to yesterday’s big winner or underweight your long term anchors. Rebalancing once or twice a year, or when allocations move beyond your pre set bands, keeps your risk in check. It’s not about chasing heat. It’s about respecting the plan.

Tools and Tactics for Smarter Allocation

Choosing the right fund, ETF, or asset class doesn’t have to be a Wall Street level mystery. Start with costs low fees matter more than most realize. Then dig into the basics: what’s the fund actually holding, and does it fit your long term goals?

Next, check risk adjusted returns. Don’t just look at raw performance. Metrics like the Sharpe ratio or Sortino ratio strip out the noise and show how much you’re earning per unit of risk. A flashy 12% annual return doesn’t mean much if it came with rollercoaster level volatility.

Also, think about how this choice fits inside your broader budget plan. A bloated allocation to one hot sector can derail the balance you’ve worked for. Use capital budgeting principles to forecast potential outcomes best case, worst case, and realistic. This is about being intentional, not reactive.

Your goal? Build a portfolio that runs like a machine efficient, low drag, and tuned to deliver over the long haul.

(See related: capital budgeting techniques)

Building (and Sticking To) the Plan

Instincts may help you survive danger, but they don’t build wealth. Emotional discipline beats gut reactions every time. The market doesn’t care how you feel. It rewards patience, structure, and rules followed with intention. A good plan keeps you from making decisions based on headlines, panic, or that voice in your head telling you to sell everything after a bad week.

That’s where a long term IPS investment policy statement comes in. This isn’t fluff. It’s your personal blueprint for why you’re investing, what you’re investing in, and how you’ll react when things go sideways. It spells out your target allocations, your rebalancing rules, and your stop points. Think of it as guardrails for your goals.

Annual reviews should feel more like maintenance than crisis response. Once a year, you pop the hood, compare your current balances to your targets, and make tweaks if something’s seriously out of line. No guesswork, no market chasing, no hunches. Just small, rational adjustments based on what the plan tells you not what CNBC shouted this week.

Wealth Is a Process Not an Event

Building long term wealth isn’t about flashy trades or trying to outguess a volatile market. It’s about sticking to a plan even when everything around you feels like it’s on fire. Markets go through phases. Your discipline shouldn’t.

The investors who come out on top aren’t the ones who obsess over daily charts. They’re the ones who automate good habits and stay the course, eyes on the long game. What helps? A systematic approach powered by smart allocation, seeded with intention and left to grow. Easy to say, harder to do which is why most people don’t.

Taxes and compounding are either your best friends or your worst enemies, depending on how well you manage them. Keep turnover low, choose tax efficient funds, and shelter growth in retirement accounts when possible. The goal is simple: Let time do the heavy lifting. No shortcuts, just compound interest stacking over years.

Allocation doesn’t have to be loud to be effective. In fact, the best strategies usually aren’t. A balanced mix that reflects your goals and timelines and is reviewed rather than overhauled wins more often than it loses. It might not make headlines, but it makes progress.

Time and structure are your edge. Want to forecast better? Take a closer look at capital budgeting techniques to understand the long view in even sharper focus.