What Value Investing Really Means

At its core, value investing is simple: buy what’s worth more than it costs. You look for assets trading below their intrinsic value stocks overlooked, misunderstood, or out of favor. It’s not about hype or headlines. It’s about digging into the fundamentals, running the numbers, and making decisions based on real world worth.

In 2026, while reactive trading and algorithm chasing dominate the noise, value investing continues to quietly outperform. It avoids the traps of market timing and speculation. Instead, it bets on time itself. History shows that when you buy strong businesses at a discount and hold through the volatility, the odds stack in your favor.

But this strategy isn’t for the impatient. It demands a mindset shaped by discipline, not dopamine. Value investors ignore the crowd. They wait when the market gets irrational, they stay focused when it gets loud. Patience isn’t passive it’s strategic. And conviction comes from putting in the work: reading balance sheets, studying sectors, and knowing why you own something. In a market chasing shortcuts, value investing still rewards those who think long and play steady.

Warren Buffett: Quality at a Fair Price

Warren Buffett didn’t just follow Benjamin Graham he evolved the playbook. His mantra of buying quality businesses at fair prices took value investing from spreadsheets to strategy. Instead of fixating on bargain bin stocks, Buffett went for companies with durable advantages brands, networks, products no one else could touch. Moats, as he calls them.

But Buffett’s edge wasn’t just what he bought it was how long he held. He focused on businesses run by trustworthy, competent managers and let compounding do the heavy lifting over years, not quarters. That patience is foreign to most investors, but it’s where the wealth scales.

Now, fast forward to today’s tech heavy, real time world. You’d think Buffett’s old school model would look outdated. It doesn’t. He’s still one of the world’s most closely watched investors because his principles aren’t anchored to eras they’re anchored to human nature. In fact, his style is built for chaos: when markets panic and valuations get silly, that’s when Buffett buys. And in 2026, with AI optimism pushing some prices into orbit, the ability to know what something’s truly worth versus what people feel it’s worth couldn’t be more relevant.

How to Apply These Strategies Today

In a market where everyone has access to the same data, separating noise from signal is the real edge. Spotting undervalued assets in 2026 isn’t about waiting for a headline correction it’s about doing the work others skip. Look beneath the hype. A company might be flying under the radar not because it’s broken, but because it’s boring or misunderstood. That’s where value hides.

Start with the fundamentals: cash flow, earnings quality, debt levels, and margin stability. But don’t stop there context matters. Zoom out. Are macro forces (like interest rates, global tensions, or AI shifts) putting short term pressure on a solid long term bet? Cheap today doesn’t mean weak; it might mean mistimed.

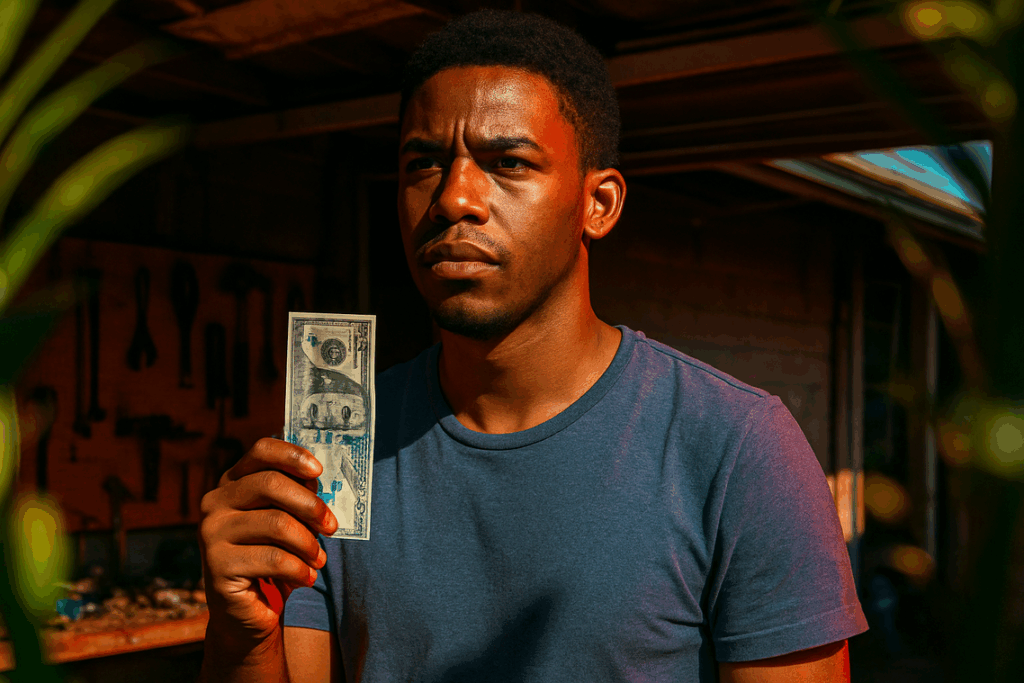

And here’s where most people lose: emotion. The market will overreact. Crowds sell in fear and buy in FOMO. Value investors stay still when others lurch. The goal is to be rational in irrational times. This isn’t about finding the next meme stock it’s about owning something solid while it’s being ignored. Then waiting. That’s the hard part, and it’s also the edge.

Reinforcing with Smart Diversification

Diversification is more than a safety net it’s a strategic extension of the value investing mindset. In today’s global, unpredictable markets, applying value principles across different sectors and geographies creates resilience and opportunity.

Applying Value Principles Across Sectors and Regions

Modern value investors must look beyond familiar industries and home markets. The ability to identify undervalued assets is transferable across borders and sectors as long as the fundamentals hold.

Sector variety: Value can be found in tech, energy, consumer goods, and even emerging industries when analyzed correctly.

Geographic reach: Markets outside the U.S., from Southeast Asia to Eastern Europe, often feature undervalued companies overlooked by mainstream investors.

Economic cycles: Some sectors thrive when others contract diversifying positions investors to benefit from different phases of the economic cycle.

Why Strategic Diversification Matters More Than Ever

The global landscape in 2026 is marked by volatility: shifting interest rates, political instability, and fast moving innovation. A value investor must buffer their portfolio against these shocks without abandoning core discipline.

Key reasons diversification is critical:

Reduces portfolio level risk from region specific economic downturns

Preserves long term value while individual holdings take time to rebound

Enhances opportunity to tap into growth without chasing fads

Learn More

For a deep dive on building a robust, diverse portfolio grounded in value principles, check out:

How to Diversify Your Investment Portfolio in 2026

Final Notes

Value investing has always looked more like a philosophy than a tactic. It’s not just about picking undervalued stocks it’s about developing a mindset that prizes discipline over flash, clarity over hype. In 2026, that mindset is still relevant, maybe more than ever. Markets are louder, faster, and built to tempt you into chasing the next big thing. The investors who win aren’t the ones trying to catch lightning, but the ones who know how to sit still when the storm hits.

Consistency matters. Making thoughtful decisions over time beats trying to time the highs and lows. Curiosity matters. Digging deep, asking the right questions, and being okay with slow answers builds durable knowledge. Patience matters most. It gives strategies space to work and keeps emotions from sabotaging good judgment.

The tools change, the markets shift, but the core of value investing discipline, focus, long term thinking hasn’t aged a bit. The truth is simple: timeless strategies still outperform trendy ones. The smart money plays the long game.